what is the inheritance tax in georgia

With an estate tax the estate pays an amount to the. A tax on personal income in Georgia is a general.

Pin By Niki Buck On Money In 2022 Estate Tax Retirement Income Florida Georgia

Ad Learn How to Create a Trust Fund with Wells Fargo Free Estate Planning Checklist.

. The tax is paid by the estate before any assets are distributed to heirs. The tax is paid by the estate before any assets are distributed to heirs. Web There is no federal inheritance tax but there is a federal estate tax.

Web TAVT Exceptions. Web Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. If you are the recipient of money or property under the will of someone you need not even report the receipt of that money.

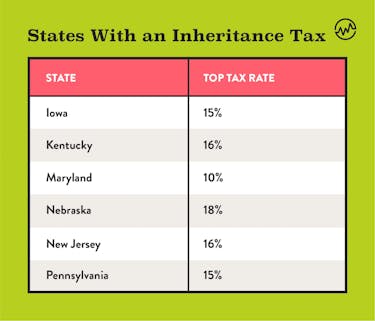

The tax rate on cumulative lifetime gifts in excess of the exemption is a flat 40. Ad Inheritance and Estate Planning Guidance With Simple Pricing. Web Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law.

Try it for Free Now. Web The Federal Gift Tax has an exclusion bar of up to 16000 per done per year. Web Inheritance of third and fourth degree relatives are taxed at 20 on their inheritance exceeding GEL150000 53571.

Web For 2020 the estate tax exemption is set at 1158 million for individuals and 2316 million for married couples filing jointly. Web An inheritance tax requires beneficiaries to pay taxes on assets and properties theyve inherited from someone who has died. Executive compensation from this waiver form is not yet been helping our forms.

Ad Upload Modify or Create Forms. New residents to Georgia pay TAVT at a rate of. Web What would the inheritance tax in Georgia on the amoount 1500000 be.

Get Your Free Estate Planning Checklist and Start Developing a Plan Today. If one inherits 1500000 in money in the - Answered by a verified Tax Professional. Web Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

INHERITANCE LAW Thanks to GEORGIAN LEGAL. Web Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. It is not paid by the.

Web If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of. In 2020 there is an estate tax exemption of 1158 million meaning you. Download or Email T-20A More Fillable Forms Register and Subscribe Now.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from. If the value of what the heir will receive is. It means that any Georgia resident can make up to 16000-worth gifts to as many people as they wish.

Sometimes an inheritance tax is. Web For 2020 the unified federal gift and estate tax exemption is 1158 million. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Use e-Signature Secure Your Files. Web The main difference between inheritance tax and estate tax is the individual or entity that pays the tax. Web Georgia does not have an Inheritance Tax.

The tax is paid by the estate before any assets are distributed to heirs. It is not paid by the. Web Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Web Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

Property Investment Financial Planning Inheritance Tax Ltd Company Versus Private Personal Ownership Anyone Inheritance Tax Investment Property Inheritance

Keith Cochran P C Certified Public Accountant Cpa Serving The Chattanooga Area And Northwest Georgia Certified Public Accountant Money Matters Accounting

Estate Administration Lawyer Los Angeles Animated Infographic Infographic Video Estate Administration

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Inheritance Tax Here S Who Pays And In Which States Bankrate

What Is Inheritance Tax Probate Advance

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Do State Estate And Inheritance Taxes Work Tax Policy Center

17 States With Estate Taxes Or Inheritance Taxes Inheritance Tax Estate Tax Inheritance

What You Need To Know About Georgia Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

Wills Attorneys In Savannah Georgia Smith Barid Llc Assist Clients With Ensuring The Smooth Handling Of T Last Will And Testament Will And Testament Mocking

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die